Understanding the AMD PEG Ratio: A Powerful Valuation Tool

The Price-to-Earnings-to-Growth (PEG) ratio offers a refined approach to valuing stocks like AMD, going beyond the simpler Price-to-Earnings (P/E) ratio. It incorporates the anticipated growth rate of a company's earnings, providing a more nuanced assessment of whether a stock is undervalued or overvalued. A lower PEG ratio generally suggests a potentially undervalued stock relative to its growth prospects. However, it's crucial to remember that the PEG ratio is just one piece of the puzzle; relying solely on it can be misleading.

Decoding the Calculation: How to Determine AMD's PEG Ratio

Calculating the AMD PEG ratio involves a straightforward three-step process:

Determine AMD's P/E Ratio: This is readily available on most financial websites. It's the current market price of AMD's stock divided by its earnings per share (EPS). This indicates the price investors pay for each dollar of AMD's earnings.

Identify AMD's Projected Earnings Growth Rate: This is where careful consideration is paramount. Analysts provide forecasts for AMD's earnings growth over a specific period (typically one or five years). Scrutinizing these projections is vital. Are they realistic given AMD's competitive landscape and broader market conditions? Consider multiple sources and compare projections.

Calculate the PEG Ratio: Divide AMD's P/E ratio by its projected annual earnings growth rate. The resulting figure is the PEG ratio.

Example: If AMD's P/E ratio is 25 and analysts predict a 15% annual growth rate, the PEG ratio is 1.67 (25 / 15).

Interpreting the PEG Ratio: Insights, Not Guarantees

A PEG ratio below 1 is often interpreted as suggesting the stock may be undervalued, while a ratio above 1 might suggest potential overvaluation. However, this is a simplification. Several crucial factors require consideration:

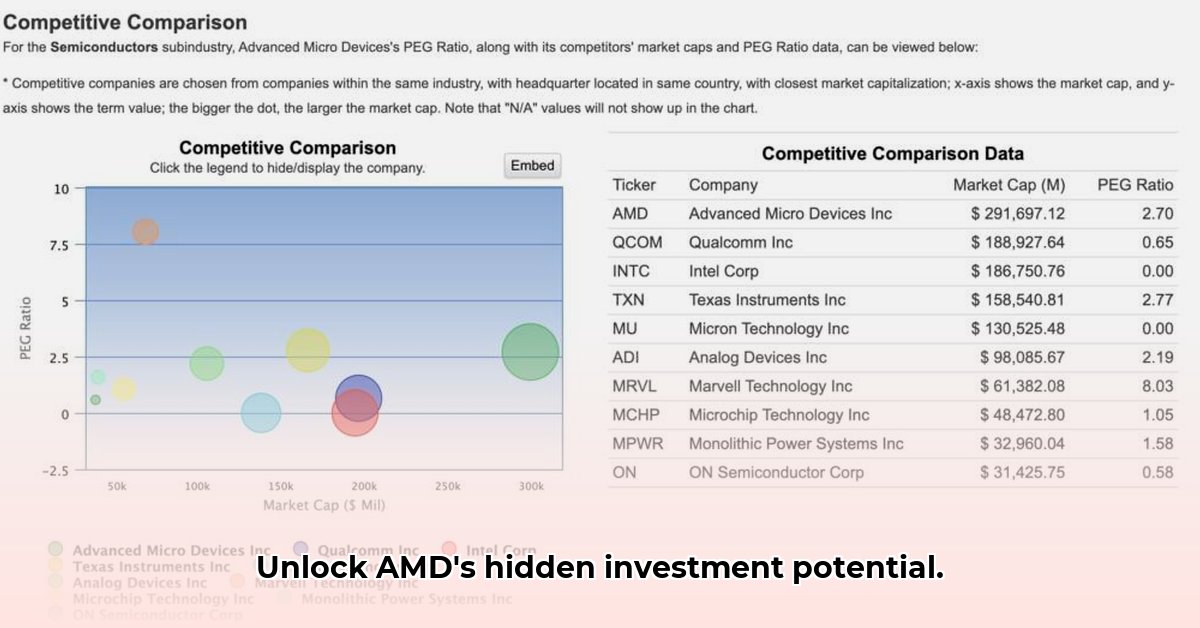

Industry Context: The cyclical nature of the semiconductor industry, to which AMD belongs, necessitates a broader perspective. Booms and busts significantly influence valuation metrics. Comparing AMD's PEG ratio to industry averages provides valuable context.

Company-Specific Factors: AMD's competitive position, innovative products, and management team all play a significant role in shaping its valuation. A strong competitive advantage might justify a higher PEG ratio.

Time Horizon: The duration of the growth rate prediction is crucial. Short-term predictions are less reliable than longer-term projections.

Integrating the PEG Ratio into Your Investment Strategy: A Holistic Approach

While the PEG ratio offers valuable insights, it shouldn't be the sole determinant of your investment decisions. A comprehensive strategy requires a multi-faceted approach:

Combine with other metrics: Consider other valuation measures, such as the price-to-sales ratio or discounted cash flow analysis. A balanced assessment uses multiple tools to gauge value.

Conduct thorough due diligence: Thoroughly investigate AMD's financial health, competitive positioning, and management capabilities. Understanding the company's intrinsic strengths and weaknesses is essential.

Account for market conditions: The overall economic environment heavily influences stock performance. Factors like interest rates and inflation can significantly impact a company's growth trajectory.

Mitigating Risks: Potential Pitfalls of the PEG Ratio

Using the PEG ratio involves several potential drawbacks:

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Unrealistic Growth Projections | High | High | Compare multiple analyst estimates; consider historical growth trends; account for potential market disruptions. |

| Analyst Bias | Medium | Medium | Consult numerous and varied sources; acknowledge analysts may have inherent biases. |

| Market Volatility | High | High | Diversify investments; implement stop-loss orders to limit potential losses. |

| Unexpected Events | Medium | High | Stay informed about news affecting AMD and the broader technology industry. |

Conclusion: A Powerful Tool in a Broader Investment Strategy

The AMD PEG ratio is a valuable tool for assessing AMD's stock valuation, but it should be viewed as one data point among many. By combining the PEG ratio with other fundamental analysis and taking into account market conditions and risk tolerance, investors can create a more robust investment strategy. Remember, successful investing requires a holistic approach, incorporating diverse perspectives and mitigating potential risks.